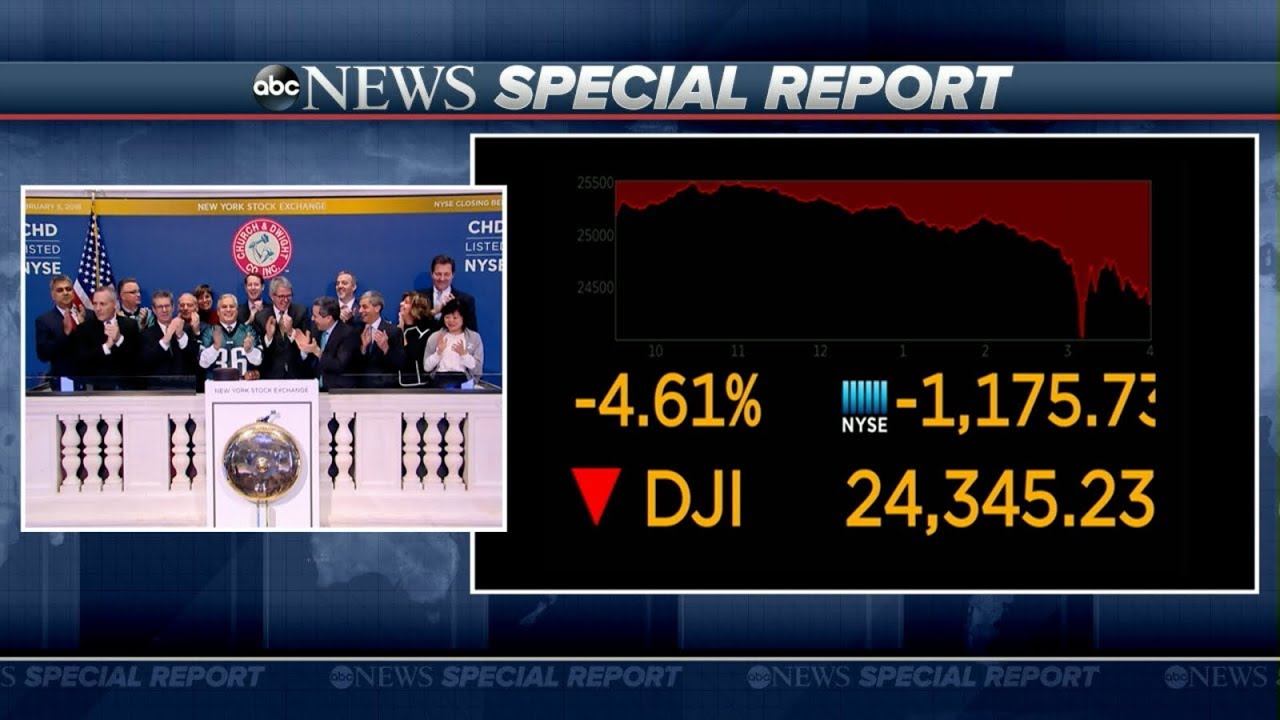

Stock Market Crash of 2020 – My Recession Plan

Will There Be A Stock Market Crash in 2020? Here is my investing plan for the recession ► My Stock Portfolio: ► Get 2 Free Stocks on WeBull when you deposit $100 (Valued up to $1000): ► Try Audible and Get Two Free Audiobooks: ► M1 Finance Roth IRA: ► Stocking Stuffers for the Holidays: […]